BLOG

Five Ways to Design Impactful Experiences in Financial Services

Our research shows that brands should prioritize changes that focus on growth, agility and holistic perspectives.

Historically, product and price were the go-to levers for financial services leaders looking to drive growth, however, the importance placed on experience innovation today means it is now the most critical area of investment. Strategic and thoughtful experience design addresses the evolving expectations of digital-first customers, the increasing complexity of channels and business models and the growing reserves of untapped data across financial services relationships.

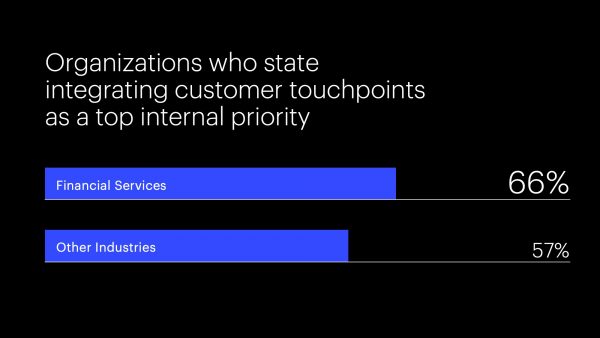

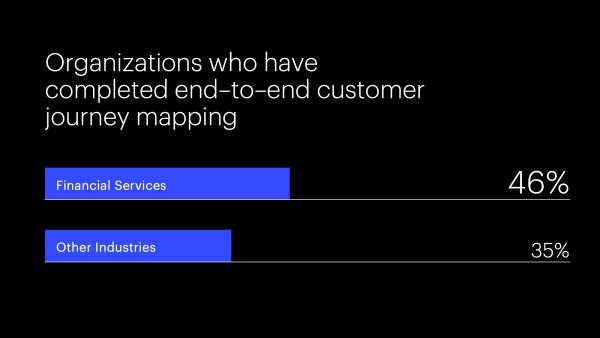

The industry is already taking notice. As uncovered in Altimeter’s State of Digital Transformation report, two-thirds of financial services organizations say ensuring a more consistent experience across touchpoints is a top internal priority, compared to just over half across other industries. But less than half of financial services organizations have taken the crucial step of mapping the end-to-end customer journey.

Designing effective experiences requires following a deliberate process that balances external and internal considerations, and creative analytical approaches. Over the course of working with hundreds of financial services clients around the world, we’ve found that the companies who best capture opportunities in experience innovation exemplify five key principles:

- They are human-centric

- They are growth-oriented

- They are operator-obsessed

- They bring a holistic perspective

- And they are designed for agility

The 5 Key Principles Required For Experience Innovation

Let’s dive deeper into what these principles look like in action:

Human-centric

In the past, financial services companies might have designed customer experiences from the inside out, building a profitable experience first and then finding a market for it. But experiences today must start with the needs of the people for whom they are designed – whether mass affluent consumers, high-net-worth individuals, captive agents, branch employees or independent advisors.

Established financial services firms can learn from newer players who have adopted a human-centric mindset to design for latent needs. Ellvest, for example, is an investment company that recognized most providers cater to a definitively male audience and saw an opportunity to build a brand designed for female investors’ unmet needs such as clearer access to female advisors, and a broader range of investment strategies. Ellvest has designed experiences that directly address these challenges, from providing tailored recommendations based on gender-specific salary curves to including larger retirement targets for longer female life expectancies. Taking a human-first approach has positioned Ellvest to capitalize on significant economic opportunity, given that women are expected to hold $72 trillion of private wealth by 2020.

Growth-oriented

While better catering to customer needs and behaviors, experience investments must drive business growth. In financial services especially, legacy business models can hinder brands from moving quickly enough to capitalize on growth opportunities to get access to new revenue sources and untapped customer data.

One way in which incumbent brands can better shift to market dynamics and customer needs is through strategic partnerships or purchases to get access to new platforms and technology, rather than building entirely in-house.

AXA recently partnered with insurtech company, Slice, to offer on-demand cyber insurance to small businesses – specifically, taking a policy normally sold with a $5-$10 million limit, and bringing it down to $250,000 to $3 million. The platform, powered by Slice, allows small business customers to purchase comprehensive coverage in a matter of minutes, submit the first notice of loss through claims bots and offers insightful data to help SMBs understand their cyber risk exposure. Customers also see an individualized dashboard with an overall cyber risk assessment and scores along with benchmark scores of their industry peers across each risk category. By partnering with an emerging player, AXA was able to bring the first-in-kind product to market in just three short months – delivering unique value to a new customer base while growing the business and tapping into new data.

Operator-obsessed

Experiences must be designed as much for the people and operators responsible for delivering them – employees, agents, call center reps, front-end developers or data scientists — as for the end-user, keeping feasibility of implementation and management top-of-mind.

When Prophet redesigned the treasury management experience for a large US bank, we took operators’ considerations into account throughout – understanding the business context, technical constraints and needs of the users responsible for serving the target clients. Through key use cases for both operators and clients, we designed and delivered a reimagined digital treasury management experience that followed an ideal journey with a responsive and mobile-first interface.

Holistic Perspective

While considering the needs of internal operators, financial services companies must also ensure organizational silos don’t lead to fractured ownership of experiences. Ultimately, financial services customers don’t care about organizational complexity; they just want solutions that consistently meet their needs across channels and touchpoints. Part of addressing internal challenges well means taking a holistic perspective to experience design.

The largest legacy banks in the US recognized this opportunity when they partnered to create Zelle, a peer-to-peer payments platform that integrates directly into existing banking apps. Eliminating the need to leave the secure environment of users’ personal banking apps, Zelle enables seamless money transfer through a single, trusted experience. Beyond successfully collaborating across internal groups—analytics, IT, marketing, and more — to bring this to market, these brands managed to break down competitive siloes to create greater value for the end-user.

“Ultimately, financial services customers don’t care about organizational complexity; they just want solutions.”

The result? Last year alone, users moved $119 billion through Zelle – nearly double the $62 billion moved through Venmo, which requires users to connect their bank account with the external app. And the holistic nature of the experience only continues to improve, with the number of participating regional banks increasing by over a third in early 2019.

Designed for Agility

Perhaps the most obvious difference between legacy financial services companies and their younger, fast-growing competitors is the rate at which they can move and adjust. Yet even the largest financial services firms can design experiences adaptable to rapidly evolving customer expectations and market conditions.

For example, Chase invested in new tools and processes to move with greater agility when launching experiences. The strategy included adopting an open API store and micro-services in its digital development, capitalizing on the rich data of its 47 million digital customers and implementing Scrum work processes. Chase’s agile design process led to the complete overhaul of its online and mobile experience in just 18 months.

Designing for agility should not be confused with the “move fast, break things” mantra of many Silicon Valley digital disruptors. In legacy financial services businesses, breaking things is not an option. Chase’s agile transformation has only improved its operating efficiencies, achieving a 99% straight-through processes rate on more than $5 trillion daily wholesale payments and lowering the cost per check deposits by 94% through digital transactions.

FINAL THOUGHTS

As legacy financial services brands continue to focus on building experiences that allow them to challenge and surpass their disruptive competitors, these five principles can serve as north-star guides.

If you’d like to learn more about how experience-led innovation can drive growth in your business, please contact us today.