BLOG

Naming Strategies and Market Dynamics Will Tip the Scales in the Streaming Wars

In the crowded world of new streaming services, name choice is one of the important decisions companies make.

Global stay-at-home orders due to COVID-19 have caused streaming traffic to surge just as the category once dominated by Netflix is seeing an influx of competition from industry veterans, tech giants, startups, and everything in between.

Launch momentum is vital to these subscription services, as the platforms rely on the buzz from early adopters to lay the foundations for success. For customers determining which of these nascent services to add to their monthly bills, the decision comes down to preconceived notions of the quantity and quality of existing content, as well as trust in future production capabilities. Brand perceptions are key to generating momentum at launch and in turn, to the long-term viability of these services.

“Brand perceptions are key to generating momentum at launch and in turn, to the long-term viability of these services.”

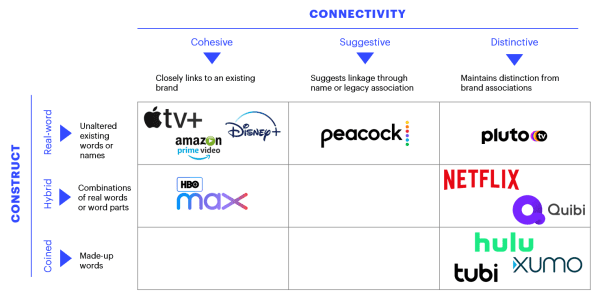

At this critical early stage, one strategic decision to leverage and build brand perceptions has been naming architecture: the extent and manner to which the service’s name links to the recognized parent brand. While startups will inherently launch with a new name, most streaming entrants represent a strategic investment by a larger company with entertainment aspirations. These players must determine whether the brand name should emphasize cohesion with the master brand – as in the case of Disney+ – or create a level of distinction from it – as in the case of NBCUniversal’s Peacock.

Of course, there is no one-size-fits-all answer to the question of naming architecture. Each brand must determine the optimal solution based on its unique equities, credible capabilities and strategic ambitions. Companies need to leverage the perceptions that will help them in this particular industry at this exact moment and build or partner to achieve the equities they lack.

These naming considerations play a key role in generating momentum and encouraging trial and subscriptions, but the impact of today’s market dynamics must be considered as well.

Let’s take a look at both the naming strategies of these new services as well as the potential impact of today’s unprecedented market conditions as they relate to the success of the platforms.

Disney+

In its first six months, Disney+ has been a success story. Historically, Disney has at times named its owned brands to maintain the distinction, like with ABC and ESPN, and it continues to do so with existing streaming services Hulu and ESPN+. With Disney+, however, it appeals to children and adults of all ages by leveraging the strong equities of the legendary Disney brand name to instantly bring to mind its inspirational and emotional stories and characters. In fact, in the 2019 Prophet Brand Relevance Index, Disney ranked number one in the “distinctively inspired” category out of over 200 brands tested, with consumers praising the brand for its ability to make them happy and connect with them emotionally.

The Disney+ name draws an unmistakable connection between the new streaming service and this beneficial legacy, and consumers have heard the message loud and clear. With a stated goal of 60 to 90 million subscribers by the end of the fiscal year 2024, Disney+ exceeded all expectations and boasted 50 million members just five months after its launch.

While naming indeed plays a key role in initial launch success, we must acknowledge that the current global pandemic has thrown a Wreck-It Ralph-sized wrench into the industry, and Disney now faces an uphill battle with retention. The launch strategy leveraged the Disney brand to connote nostalgia and the global pandemic delivered additional sign-ups, but the company was banking on original content in 2020 and 2021 to supplement its kid-friendly library with more new content for older viewers.

Now, with global productions shut down due to COVID-19, Disney is hungry enough for new content that the studio announced it will fast-track the release of its film adaptation of the Tony and Pulitzer Prize-winning Broadway show, “Hamilton,” straight to Disney+ July 3rd, over a year ahead of schedule. With the flex, Disney sends a strong reminder to the industry that its arsenal of content is deep enough to sustain the service through the pandemic, and that it is willing to join the growing trend of releasing theatrical-quality content directly on home entertainment.

Apple TV+

If Disney+ demonstrates the opportunity in leveraging a strong existing brand name, Apple TV+ demonstrates the risk to streaming success. Tellingly, the company hasn’t announced its Apple TV+ paid subscriber numbers, but bad reviews and the departure of its head of content a mere two weeks after launch, signal an underwhelming start for the service. In a bid to accelerate momentum, Apple has included free Apple TV+ membership with every device it sells. And yet, even with the streaming service available for free, Bloomberg estimates that only 10 percent have activated their free accounts. Google trends also show a lack of consumer appetite for Apple TV+. Launching within weeks of Disney+, Apple TV+ has consistently generated far less buzz.

Disney+ and Apple TV+ adopted quite similar naming strategies, but the varying success can be partially attributed to the specific equities that each name holds in the minds of consumers. While Apple registered as the number one overall brand in the Brand Relevance Index, its strengths lie in innovation – it outperforms all other brands in measures of modernity and ability to push the status quo. The revered Apple brand name instantly connotes sleek and cutting-edge technology and cross-product integration. Even when the company caught lightning in a bottle in reshaping the music industry, it did so through a game-changing integration between iTunes software and iPod hardware – it never became a record label itself. In the streaming space, customers crave character development and intriguing storylines. Device manufacturing capabilities are less relevant.

Even with the most powerful brand in the world, tying the streaming service so close to the master brand – and with a name that potentially creates confusion with the existing Apple TV hardware product – may have contributed to the lackadaisical launch. Now, Apple is investing billions in deals with top-tier showrunners and production studios, including a production deal with former HBO CEO Richard Plepler, in order to build its perception as a content creator from the ground up. Perhaps in this case, Apple would have been better served by partnering with a respected industry veteran to accelerate the launch as it entered the new industry, a strategy it successfully employed in partnering with Goldman Sachs to launch the Apple Card.

HBO Max

How will WarnerMedia’s HBO Max streaming service fare when it launches tomorrow?

With a similar naming strategy driving cohesion with the existing entertainment brand, the new service will immediately remind consumers of the company’s legacy of captivating characters and content across genres, from The Wire and Game of Thrones to Curb Your Enthusiasm and Veep. With relevant brand equities in the HBO name, the launch may see momentum closer to Disney+ than Apple TV+. However, with two separate streaming services called HBO GO and HBO NOW already in the market, WarnerMedia will need to clarify its offerings to avoid confusion as it launches HBO Max.

Once again, the naming decisions must be considered in tandem with market dynamics, which will hugely impact the service’s success. After paying $425 million for the exclusive streaming rights to Friends and offering each cast member over $2.5 million for a single new reunion episode, the pandemic disrupted production and forced the platform to launch without this marquee original content. HBO Max is forced to deal with pandemic-induced challenges even beyond the production issues of Disney and Apple, as debuting mid-pandemic also jeopardizes its initial marketing campaign. Now, not only will the service enter the fray without its key Friends original content, the platform will also launch without its March Madness media blitz and other premiere advertising opportunities.

Peacock

As streaming entrants join the industry from all angles, we also see examples of brand names that create distance from parent companies or that are new to the market, both from established players and startups.

NBCUniversal will launch its Peacock streaming service on July 15, opting for a name that creates more distinction from the parent than the Disney, Apple and HBO services that carry the parent name. The Peacock name is instead a nod to the NBC logo first introduced in 1956 to emphasize the network’s innovative new color TV capabilities and is a fitting homage as the company launches its next-generation content delivery platform.

In the case of NBC, this is an interesting decision. Consumer perceptions of the NBC name are less tied to the brand’s content, so Peacock may prove advantageous to a name like NBC+. As popular as the content may be, many younger viewers don’t associate the studio with The Office or Parks & Recreation, as the shows have been syndicated to other networks and available on Netflix for many years. Other shows produced by the studio, like Brooklyn Nine-Nine for example, aired on other networks from day one. So, while customers may clamor for the shows they love, the NBC name wouldn’t be particularly helpful in gaining brand loyalty.

The same can be said for Universal Pictures – the average viewer doesn’t immediately associate the studio with movies like Jurassic Park, Knocked Up or Back to the Future. The Peacock name can create distinction from NBC to allow the platform to encompass both NBC and Universal content, and the more contemporary feel connotes modern technology rather than just the digital arm of a TV network.

Of course, Peacock will face many of the same challenges as HBO Max in launching during a global health crisis. The debut was positioned around the 2020 Olympics, with plans to promote the platform during the televised events, as well as air exclusive Olympic programming on the streaming service. With the Olympics and other sporting events postponed, NBCUniversal loses thousands of hours of programming and ad revenue. Further, while the ad-supported nature of Peacock differentiates it from other streaming players, it also creates questions in a post-COVID world. Will customers prefer the service because it offers content without a monthly subscription? Or on the flip side, will advertisers cut their ad spend without the Olympics drawing in viewers?

Quibi

Finally, Quibi launched in early April with a promise of premium content on the go. The startup (if you can call a $2 billion investment a “startup”) was launched by Dreamworks co-founder Jeffrey Katzenberg and offers professional quality content in episodes no longer than 10 minutes. The content is created for viewing on mobile devices – think Netflix-caliber content for TikTok attention spans. The Quibi name is a portmanteau meaning “quick bites,” a moderately coined name intended to describe the offering in the short-term and, if successful, eventually become common lexicon itself. In addition to hinting at the short-form nature of its content, the name proudly asserts its startup status through its use of modern naming trends, beginning with “Q” and ending with “I”. Netflix took a similar semi-descriptive naming approach and grew into the biggest player in streaming, so the strategy can hardly be scoffed at – though Quibi’s descriptive meaning is not as immediately apparent as that of Netflix.

While Quibi arguably has the potential to change the streaming industry with its short-form content, it also has faced the strongest headwinds in launching mid-pandemic. With a value proposition centered around on-the-go viewing, global lockdowns have hit the streaming startup particularly hard. Episodes are meant to fill gaps in consumers’ days as they brew their morning coffee or wait for the bus, so the relevance of this offer is questionable as commuting routines face permanent changes. Even before the pandemic though, the concept was far from a sure bet. Does the appeal of short-form content platforms like YouTube and TikTok stem from the democratization of production that allows anyone with a camera and the internet a chance to go viral? Or is there an unmet need for short-form content featuring A-list production and talent? Quibi posits the latter, offering content featuring A-list talent from accomplished actors like Christoph Waltz and Kristen Bell and inspirational athletes like Megan Rapinoe and Lebron James.

FINAL THOUGHTS

The future streaming leaders will surely be determined in large part by content, user experience, pricing strategies, and market conditions out of anyone’s control. Nonetheless, as new entrants continue to saturate the streaming space, generating momentum will be imperative to long-term success. Naming choices will continue to play a key role in building brand perceptions to accelerate customer acquisition.