BLOG

CEO Perspectives: The 5 Most Pervasive Mistakes in Acquiring a Healthcare Startup

Acquiring small companies can open many doors for healthcare brands. Here’s how you can do it right.

Over the past three decades, acquisitions have shifted from acquiring for scale to acquiring for capabilities – often to accelerate digital transformation efforts. Prophet’s M&A team has noticed an unfortunate pattern of these new “acquisitions-for-capabilities” failing. This topic is often studied from the acquirer side, normally around the deal structure and integration management office (IMO). However, less is understood from the side of the acquiree side, particularly the younger, smaller startups that are quickly picked up by large multi-billion-dollar enterprises.

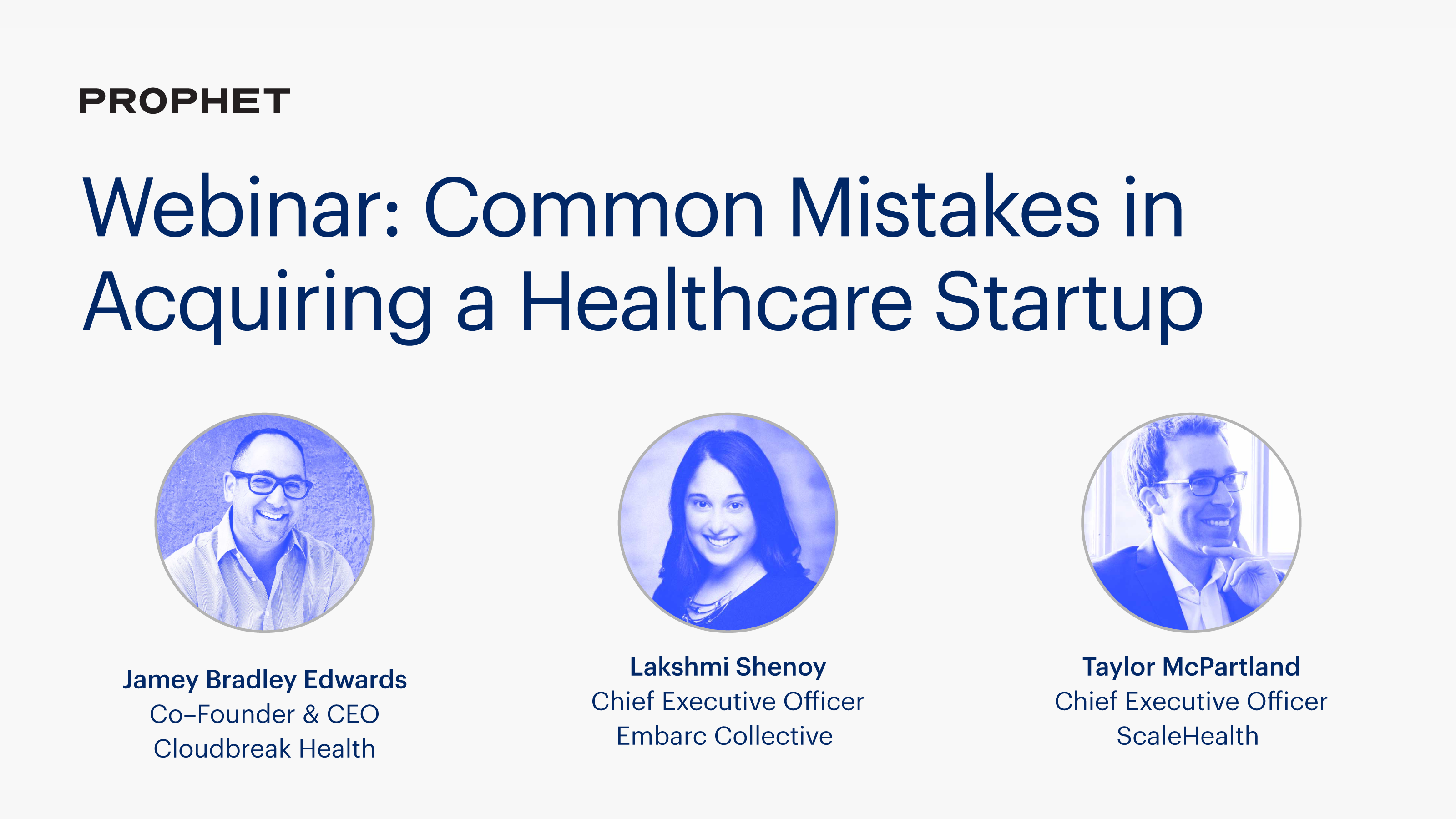

I sat down with three leading CEOs in the startup space – Taylor McPartland of ScaleHealth, Lakshmi Shenoy of Embarc Collective and Jamey Edwards of Cloudbreak Health – to better understand both sides of a startup acquisition deal.

Based on our discussion, here are some of the more pervasive mistakes in acquiring a healthcare startup:

Mistake #1: Thinking the startup views the acquisition as the finish line

As Jamey puts it, “Most people don’t realize that entrepreneurs view an exit as one chapter ending, and another beginning. But, it’s still the same book.”

Many founders want to see their vision continue to flourish and grow. There is a misperception that founders are in it for a big payday, but that’s not always the case. Particularly in healthcare, where most startups are mission-driven, the acquisition is the beginning of something newer and better for the founder.

Lakshmi added, “Even if you’re not working 24/7 after the acquisition, as a founder, you’re thinking about your startup 24/7. Founders need to consider whether they want to part ways and let someone else be the custodian of their vision.” This is equally important for the acquiring enterprise to understand these intentions as well (beyond the contracted incentives).

Mistake #2: Not being clear on the “why”

“You have a 50/50 chance in creating value from an acquisition,” Jamey explains. “So, the ‘why’ is really important.”

The “why” often gets lost in the contentious negotiating phase, where each side is more focused on the price of the transaction, and little attention is paid toward life afterward. As Taylor puts it, “One of the first pitfalls is that a lot of hope is put on the acquisition, and one way to mitigate that is to have a clear understanding of the purpose of the transaction. Is it for the talent? The culture? Technology? Market access? Either way, the mission and intention of the acquisition need to be kept front-and-center.”

Mistake #3: Letting process get in the way of problem-solving

Most multi-billion-dollar healthcare enterprises are not digitally native. As a result, their heritage stems from scaling research (pharma), services (health systems) or engineering (med-devices). Hence their DNA is process and mastering and repeating that process.

“Most people don’t realize that entrepreneurs view an exit as one chapter ending, and another beginning. But, it’s still the same book.”

– Jamie Bradley Edwards

Process is often a good thing, but if not viewed with open eyes, it can accidentally become limiting. The intricacies of enterprise decision-making can be very foreign to a startup. As Jamey explains, “There’s a lot of enterprises that have been very successful being focused on the process. If you go from getting decisions made in a week and it now takes a month, that is going to be very frustrating for development teams that are used to working in agile.”

Lakshmi highlights that process -in the worst cases – can push away great talent. “You might have the right tech. You might have the right people. But the messiness occurs within the process. If you are impeding the team’s ability to solve problems – which is what founders of startups do – that is a very fast way to demotivate them.”

Mistake #4: Assuming the acquisition deal is understood throughout the entire organization

It’s important to recognize that a founder is often negotiating with the enterprise’s deal team. Those individuals will often not be the people (s)he interacts with daily after the transaction. More importantly, you’ll have dozens of people that need to gel and work together who are not part of the deal conversations at all.

As Lakshmi puts it, “You must think of the team members who are not in the room when promises are being made, as many did not necessarily join that startup to be part of a giant organization. It can challenge the many motivations as to why they do their job.”

Taylor added, “It can be hard to quantify what culture means but it really is the through-line that made the company attractive to begin with. If you’re not hyperconscious of the new culture you’ve created, you run the risk of alienating team members before you ever realize the value you hoped for.”

Mistake #5: Letting perfect be the enemy of good

It’s important to know that larger enterprises have different risk tolerances than smaller ones. According to Jamey, “Large organizations have existing cash cows that they want to protect that.” And that risk-averse culture often weaves its way into excessive processes. This in-turn begins to work against the agility of the acquired startup, and that agility is often the desired trait that the acquiring company wants to adopt.

He continues, “Founders start by doing a bunch of missionary selling with scrappy individual reach-outs, and over time that begins to morph into more tech, Salesforce CRM, SEO, etc… And we’ve learned, as a startup, that perfect is the enemy of good. Get something out there and continued to learn via continuous improvement.”

FINAL THOUGHTS

Broadly speaking, everything comes down to alignment and empathy throughout both organizations. It appears that when things go wrong, too much emphasis is on the “thing and processes.” And when they go well, there is a strong connection through a shared purpose, an understanding of where each side thrives and a shared ambition around where they are collectively moving next.