BLOG

Unlocking Sustainable Growth

How companies can link ESG strategy to business objectives to drive growth and shared value

In response to the rising demands of stakeholders, companies are racing to put out sustainability commitments, with 92% of the S&P 500 now publishing these reports.

It’s an important shift. Companies with established environmental, social, governance structures have integrated ESG thinking into every aspect of their business – increasing transparency, rethinking environmental impact and improving how they treat employees and other stakeholders. Job seekers, particularly the newest entrants to the workforce, will disproportionately want to work for organizations with an established ESG strategy over others. New hires are also more likely to stay if the intensity of the business’ actions matches the commitments. Lastly, ESG matters more to investors, with 85% of investors now mulling a company’s ESG status before buying shares.

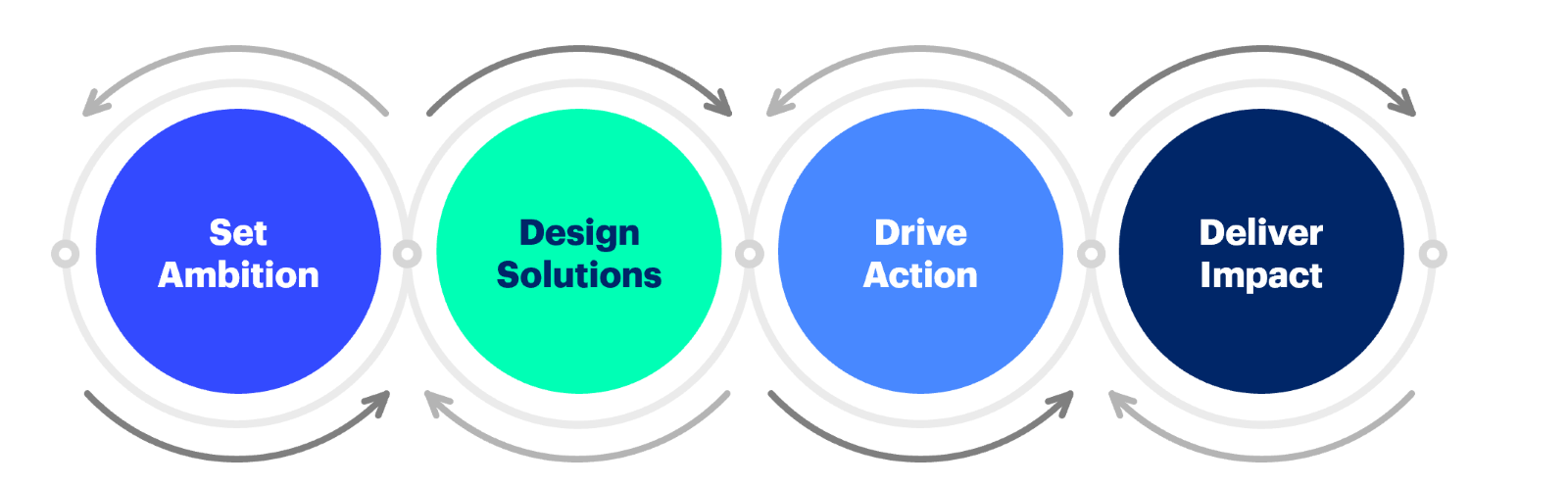

Many companies, though, are struggling to connect their commitments to action. They set ambitious targets–and that’s a good start. But once it comes to integrating ESG across the business, change leaders often don’t know how to navigate the path from ambition to demonstrable impact. It can be hard to build positive business cases for ESG initiatives. This is because there often isn’t a clear operating model for driving durable change and an ESG strategy requires collaboration across all parts of the business.

We think another major problem is that many companies still see ESG primarily as a compliance and risk mitigation tool, almost exclusively.

But we recognize it as a bigger opportunity, offering the potential for shared value creation. And there are many reasons to believe that ESG will be the next big driver of growth and transformation in the coming decade.

As companies use ESG strategies to find more purposeful, inclusive and regenerative business models, they create value in important ways:

Attract Talent, Boost Retention and Increase Employee Well-Being

It’s hard to overstate how important positive environmental, social and governance practices are to the modern workforce. A recent study from Marsh & McLennan finds a strong correlation between high employee satisfaction and companies with the best ESG scores. These ESG outperformers are also especially attractive to students and young professionals, with 86% of employees preferring to work for companies that care about the same issues they do.

Improve Customer Acquisition and Retention to Build Brand Strength

People care–and deeply–about how companies contribute to solving key issues in our culture and society today. Consumers and B2B buyers alike want to do business with organizations that are environmentally responsible and fair to employees. They want businesses to stand for something.

Ipsos reports that 66% of U.S. adults say they prefer to buy brands that reflect their values, up from 50% in 2013. The global average is even higher, at 70% of respondents, with those in emerging markets especially likely to agree.

Optimize Supply Chains, Drive Efficiencies and Create New Opportunities

While pandemic-era shortages may have vaulted supply-chain concerns to the popular consciousness, they’ve been growing in complexity for some time. They present dizzying ESG challenges, with the average company having 3,000 suppliers for every $1 billion it spends. Supply chains are fraught with risk, with the World Economic Forum estimating they account for about 90% of all emissions and widespread human-rights problems.

Using ESG principles to optimize and build resilience into supply chains is a huge growth tool, as companies with advanced supplier collaboration and innovation outperformed their peers by 2x in growth.

Power Innovation and Lead to New Business Models, Products and Services

As companies move through the early phases of ESG–from mitigating risks and achieving efficiencies–they reach the point where the assets and capabilities that power ESG performance can simultaneously become growth tools for competitive strategy and innovation. This requires deeper bridge-building across all parts of the organization. ESG may have first emanated from investor and regulatory pressures, but as it becomes more understood throughout organizations – including product, commercial, and go-to-market leaders. This should open up new pathways to business model innovation, new services and inspire new ways of working.

Here again, bold and clear goals pay off. In a study of 1,000 companies with climate objectives, those with the most ambitious carbon targets invested the most and made significant operational changes. The result? They also drove the most innovation.

We clearly see how the principles of sustainable and socially responsible business can unlock opportunities for new products and services. The circular economy offers a $4.5 trillion economic opportunity. New business models focused on reuse, recycle and regenerate are unlocking new opportunities for innovation. Additionally, inclusive design, which embraces a larger view of the human spectrum, has proven to drive innovation that leads to business advantage.

Moving From Ambition to Impact

Companies must find new and better ways to close the gap between ambition and impact. This requires designing scalable ESG solutions, exploring requirements for change throughout the organization and developing plans that integrate ESG into companywide strategies and operations.

We’re not suggesting a common path. It’s essential to address what’s material to your industry. For example, water usage and resource availability will be crucial to CPG companies but less to professional services firms. In an analysis of 2,000 U.S. companies, a Harvard Business School study found that companies that consistently addressed material issues in ESG strategies significantly outperformed competitors. Those that paid more attention to immaterial problems, however, significantly underperformed.

Stakeholders and consumers know when companies are authentically supporting their stances with strategy and when they are greenwashing, rainbow washing and virtue signaling. 70% of Gen-Z and Millennials are skeptical of virtue signaling from organizations, and roughly 80% of companies are just going through the motions and not holding themselves accountable with measurable action, continuing to erode public trust.

It’s also important to take the ESG maturity of the organization into account. Some have been establishing and finetuning policies and programs for decades, while others are just beginning.

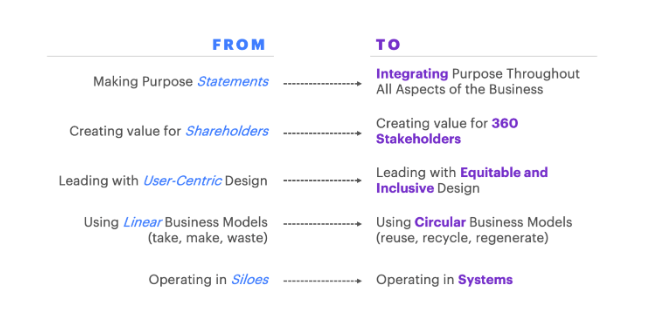

That said, there are five fundamental shifts common to every organization seeking to sharpen ESG strategies to create new value.

Companies must move from…

Embarking on Your ESG Journey

Moving from ambition to action is a complex journey. Targets fluctuate as external factors and pressures increase. And as test-and-learn efforts enrich the company’s knowledge, they become agile and confident enough to take on new endeavors.

To drive meaningful change, leaders need to evangelize the ESG mindset. Acting on these new tenets of sustainable and responsible business, they need to build coalitions, think creatively, iterate continuously and take risks. It’s a unique skill set but essential if ESG is to come to life throughout the company.

We’ve found meaningful analogies to these shifts in digital transformation. We’ve helped dozens of companies take the role of digital executives from a single department to an enterprise-wide commitment. Digital thinking now forms the backbone of a modern company’s culture, operations, go-to-market strategies and business models. In many ways, chief sustainability officers are already traveling the same path. They’re driving the ESG mindset and bringing it to life throughout the company.

FINAL THOUGHTS

It’s time for companies to tap into the transformative potential of ESG. It continues to be an important tool for compliance and risk mitigation but can do much more. With bold ambitions, close alignment to business objectives, and commitment to high-impact follow-through, the ESG mindset can create shared value and uncommon growth.